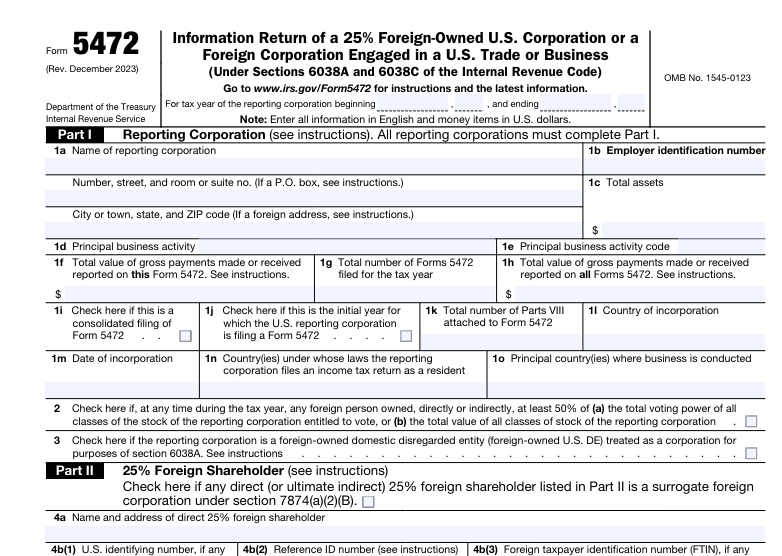

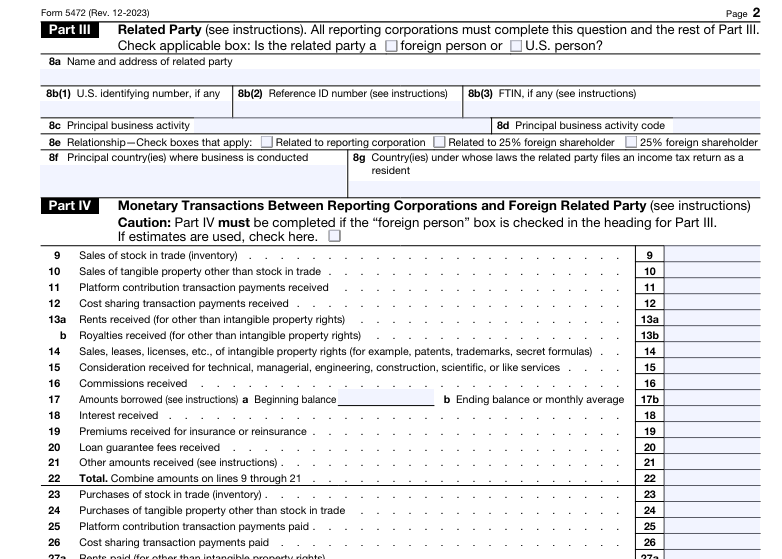

Tax regulations, especially when dealing with foreign-owned domestic corporations and foreign entities operating in the U.S., require meticulous attention to detail. Form 5472 stands as a crucial document, necessitating the disclosure of specific transactions with related parties, emphasizing the importance of accurate reporting.

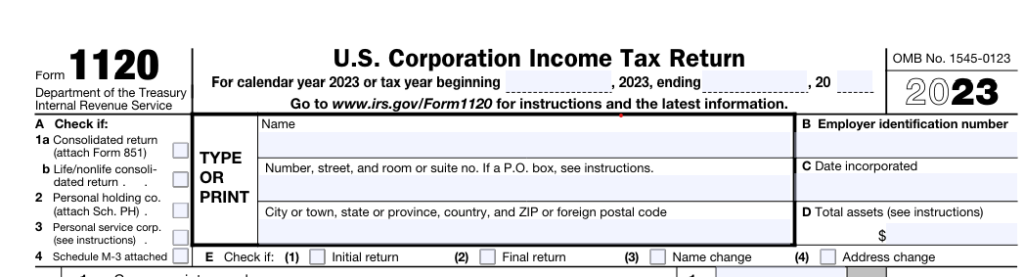

Embarking on the journey of filling out Form 1120’s initial page, the imperative act of labeling it as “Foreign-owned U.S. DE” sets the tone for providing fundamental information about the corporation. This paves the way for the exhaustive sections of Form 5472, where the identification of related parties, detailed transaction specifics, and supplementary information on transaction nature take center stage.

The gravity of abiding by IRS regulations cannot be understated. The repercussions of neglecting to file Form 5472 could result in severe penalties, potentially jeopardizing a company’s tax-exempt status. For foreign corporations that may not be actively involved in U.S. business operations but own U.S. entities, grasping the intricacies of related party transactions and their corresponding filing requirements becomes even more critical.

Navigating the labyrinth of tax requirements inherent in Form 5472 warrants a keen eye for detail and a strict adherence to established guidelines. Seeking professional guidance or expert assistance can prove invaluable in ensuring the accurate and timely submission of these pivotal documents. For any queries or support concerning tax filing protocols or compliance intricacies, do not hesitate to reach out to for https://formllc.us/ personalized assistance tailored to your specific needs.

Comprehending and complying with tax regulations may seem daunting, but with the right approach and dedicated support, foreign-owned corporations can successfully navigate the landscape, fulfill their reporting obligations, and steer clear of potential penalties and pitfalls.